In this article:

- The Four Elements of Construction Estimation

- Direct Costs

- Indirect Costs

- Overhead

- Profits

- Markup vs Margin

- The Hidden Truth to Estimation and Project Management

Estimating and Accounting, Like Venus and Mars

In 1992, Dr. John Gray published a book entitled “Men Are from Mars, Women Are from Venus: The Classic Guide to Understanding the Opposite Sex” which went on to be the highest-ranked work of non-fiction in the 1990s and spent 121 weeks on the New York Times Bestseller List. Agree or disagree with the premise of the book, the underlying concept is a difference in communicating and understanding a common issue.

In much the same way, there is often a disconnect between the Estimating and Accounting Teams within a construction company. Each is saying what they feel to be the same thing and yet often, each team takes that information and applies it in a different manner. The result of this breakdown in communication is often the source of disappointing income statements and missed expectations.

Estimating 101

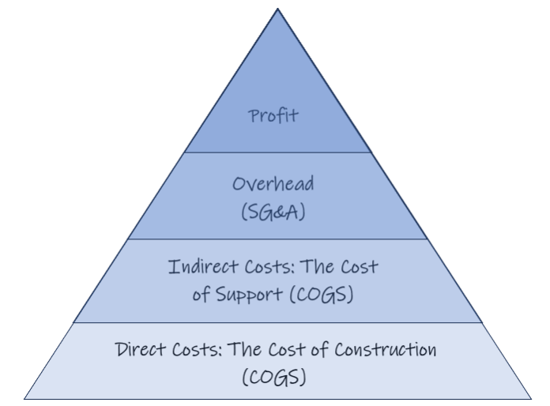

There are four elements to every construction estimate. The first is direct costs. These are essentially the costs for things that are installed at the jobsite, such as materials, workmanship (labor), and subcontracted services. In the simplest of terms, it is the cost of turning the blueprints into reality.

The next element is indirect costs, or costs that go into a project but only in a supporting role towards the final product. This category includes all the other costs that are required to execute the project successfully, such as professional services, project management labor, safety equipment, site supervision, rental equipment, dumpsters, permits, and inspection fees. While these things are necessary, they are not shown on the design documents we are bringing to life. These two elements of the estimate, known as COGS, or Costs of Goods Sold, are the world

The next element is indirect costs, or costs that go into a project but only in a supporting role towards the final product. This category includes all the other costs that are required to execute the project successfully, such as professional services, project management labor, safety equipment, site supervision, rental equipment, dumpsters, permits, and inspection fees. While these things are necessary, they are not shown on the design documents we are bringing to life. These two elements of the estimate, known as COGS, or Costs of Goods Sold, are the world

of an Estimator. If these are calculated correctly, and a project is

executed well, the project will be successful. However, it doesn’t

mean that the company will make any money.

Two more elements to every construction estimate are

Overhead and Profit.

Overhead, often referred to as Selling, General and Administrative Costs (SG&A) or Operating Expenses, is the world of Accountants. These are the costs of doing business. They include things like rent, utilities, marketing, office staff, insurance, and executive costs – these costs keep the lights on and the wheels turning. No matter what you build, you still have to pay the costs of operating a business.

Profit, the final element, is typically set by the ownership level of the company and is seen as a return on investment (ROI). It is the money left after all the bills, both construction and overhead, have been paid.

Language Barrier (Markup vs. Margin)

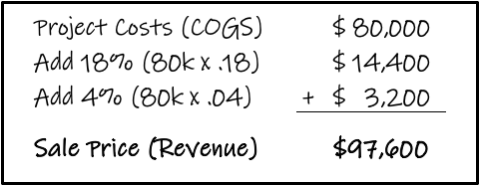

Once an Estimator compiles all the costs for the project, they get direction from the accounting department as to what percentage should be included in the estimate. Often, it sounds like, “Add 18% overhead and 4% Profit.” So what do we, as Estimators, do? Just that… we add 18% and 4% to our costs. In other words, we mark up the costs (COGS) of the project.

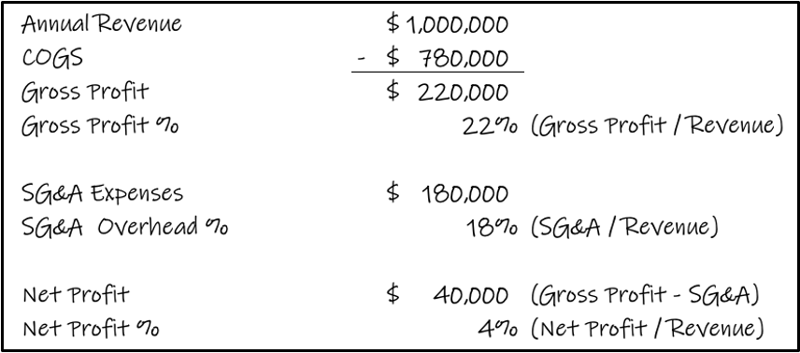

But let’s look at what the Accounting Team means when they say they need 18% to cover their overhead. SG&A is calculated as a percentage of revenue. Once all the overhead costs are added up, this amount is divided by the total revenue, often on a 12-month rolling calculation, as reported on the company’s income statement. Another way to say it is that for every $100 of Revenue, $18 will be spent to keep the lights on.

From the Income Statement, the Accounting department will determine overhead and profit levels like so:

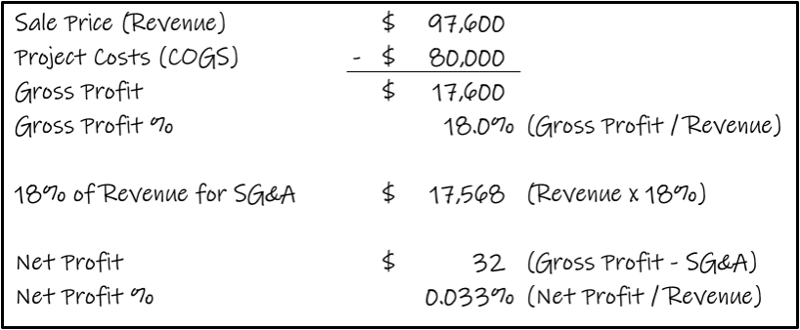

Let’s go back to our project and run the calculation the way the Accounting Team will…

While our goal was to make 4% Net Profit on the project, we ended up making only .033%! The question is… why? The answer rests in the difference between markup and margin. In the simplest terms, markup is a percentage of the costs while margin is a percentage of revenue. 25% of a smaller number will always be less than 25% of a larger one.

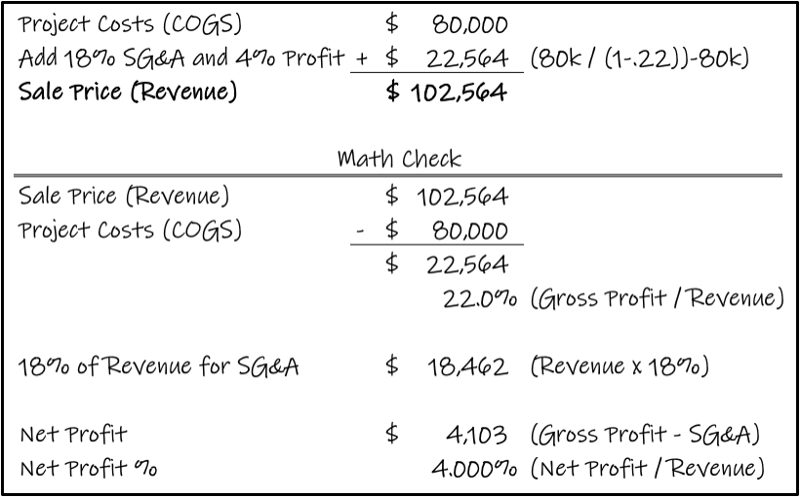

While our Accountants may have told us to “add 18% and 4%,” what they really meant was to add them as a percentage of revenue, not cost. Let’s run the calculation again, this time as a margin.

If we truly need 18% to cover overhead and want to make 4% net profit, our price needs to be $102,564, not $97,600. A common first reaction to this is “But I won’t be competitive at this price!” However, to do otherwise is to close your eyes to the true cost of running your construction business. If you really don’t think you can stay competitive, there are three basic options. First, lower your expectations of profits. Second, figure out how to lower your overhead costs. Or third, learn to become more economically efficient builders.

The Hidden Truth

As Project Managers, we are entrusted to manage the costs of our jobs. If we have a budget of $80,000 and we spend $79,900, we have delivered the project under budget and we assume that we are making money (profit)! The truth is, even if the construction costs in the estimate were calculated perfectly, the failure to calculate overhead and profit correctly will result in the company losing money, and they may not even know why.

Because our revenue (sale price or contract value) is less than it should be, the Accounting Department is dividing their SG&A costs by a smaller revenue number, which will result in the required overhead percentage being even larger. Accountants, often unaware of the calculations being used in the Estimating Department, will continue to give the estimators a higher and higher percentage, and yet the bottom line will continue to disappoint. Thus, it is imperative that the Accounting and Estimating Teams align with a common language.

So, the next time you are pricing work and the Accounting Department says to add 18% and 4%, now you know what to do!

If you're ready to start working on your business, let's talk!

Ascent Consulting’s mission is to Build Better Construction Companies.

We are committed to delivering impressive results in the areas of

profitability, performance, and growth.

Kevin Juliano entered the construction industry as a laborer. Capitalizing on a degree in Communications, he was asked to move to project management and estimating after eighteen months in the field. Since then, he has served as a senior PM, senior estimator, manager of preconstruction, regional operations manager, and executive, all primarily in heavy civil and electrical construction. Kevin has also worked for Procore Technologies as a Senior Strategic Product Consultant. Kevin has earned a BA from Wheaton College, an MA from Northwest Nazarene University, an MBA from Colorado State University, and is currently working on his Doctorate in Business from St. Leo University.

Leave a Comment

Your email address will not be published. Required fields are marked *