In this article:

-

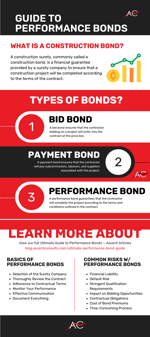

Three Common Types of Construction Bonds

-

Bid Bond

-

Payment Bond

-

Performance Bond

-

-

Understanding the Basics

-

Common Risks With Performance Bonds

Construction bonds protect project owners and stakeholders by providing financial guarantees that the contractor performing bonded work will fulfill their contractual obligations, pay subcontractors, and complete the project as specified.

There are three common types of construction bonds: bid bonds, payment bonds, and performance bonds.

Bid Bond

A bid bond ensures that the contractor bidding on a project will enter into the contract at the price bid and provide the required performance and payment bonds if awarded the contract.

Payment Bond

A payment bond ensures that the contractor will pay subcontractors, laborers, and suppliers associated with the project. If the contractor fails to make these payments, the surety company covers the costs, protecting the project owners and subcontractors.

Performance Bond

A performance bond guarantees that the contractor will complete the project according to the terms and conditions outlined in the contract. If the contractor fails to fulfill these obligations, the surety company may step in to ensure the project's completion.

Understanding the Basics of Performance Bonds

While all three types of bonds may come into play at some point throughout the life cycle of a construction company, a performance bond is the one that needs the most attention and understanding before entering into a contract. Managing a construction project involves numerous complexities and risks. One of the essential tools in mitigating these risks is a performance bond.

If a contractor fails to fulfill its contractual obligations, the client or owner requesting the bond can make a claim on the bond to receive compensation for the financial loss incurred due to the contractor's non-performance.

In essence, a performance bond protects the project’s owner or client from financial loss and ensures that the construction project is completed as stipulated in the contract. If the contractor is unable to complete the project, the surety company steps in to fulfill the contractor's obligations or compensates the stakeholders up to the bond amount.

Gain more construction business insights from our experts.

Let’s look at some of the fundamental aspects of performance bonds for contractors.

Selection of the Surety Company

Choosing a reputable and reliable surety company is paramount. Research and select a company with a strong financial standing and a proven track record in the construction industry. Verify their credentials and ensure they have experience handling bonds for projects and companies similar to yours.

Thoroughly Review the Contract

A well-drafted (and well-read) contract is the foundation of a successful construction project. Ensure that the contract clearly outlines your company’s scope of work, project timelines, quality standards, and payment terms. The performance bond should align with the contract terms to avoid any discrepancies.

Adherence to Contractual Terms

Enforce strict adherence to the contractual terms and deadlines. If your company begins falling behind schedule or not meeting quality standards, take appropriate actions as per the contract provisions. Remember that adherence to the contract is a two-way street. Be mindful that your client follows the terms and deadlines as well so that there is no impediment to a successful completion of the contract.

Monitor Your Performance

Regularly monitor your progress to assess if your Operations team is meeting the project requirements. Document any deviations from the agreed-upon plan and communicate concerns to them immediately. Early intervention can prevent minor issues from escalating into significant problems which may put the successful completion of the project into question.

Effective Communication

Maintain open lines of communication with both the client and the surety company throughout the project. Timely updates, regular meetings, clear documentation of project milestones, and accurate financial reports are essential. Effective communication helps in addressing issues promptly, ensuring your project stays on track.

Document Everything

Maintain comprehensive records of all project-related communications, changes, and incidents. Proper documentation provides a clear trail of events and can be invaluable in case of disputes. It also helps in demonstrating that you as the contractor have fulfilled your obligations under the contract.

Common Risks with Performance Bonds

Obtaining a new performance bond can be a time-consuming process, involving extensive documentation and a thorough evaluation by the surety company. This process can delay the start of a project and add administrative burdens for the contractor.

While performance bonds are a common instrument used in construction projects to help ensure the completion of a project, there are inherent risks associated with performance bonds for contractors.

To mitigate these dangers, contractors should carefully evaluate the terms of the performance bond, understand the associated costs, and work to build a strong relationship with a reputable surety company. It is also essential for contractors to manage their projects effectively to reduce the risk of default which could lead to a claim on the bond.

Let’s look at some of the most common risks associated with performance bonds.

Financial Liability

If a contractor fails to complete a project according to the terms of the contract, they can be held financially liable for the bond amount. This can be a significant financial burden, especially for smaller contractors.

Default Risk

In the event that a contractor defaults on their obligations, the surety company may step in to complete the project or hire another contractor to do so. This can damage the reputation of the defaulting contractor and make it more challenging for them to secure future contracts. Defaulting on a bonded job should be avoided if at all possible.

Stringent Qualification Requirements

Surety companies often have strict qualification requirements for new contractors seeking performance bonds. Contractors may find it difficult to meet these criteria, limiting their ability to bid on certain projects. Contractors who already have a bonding relationship are also subject to ongoing qualification requirements and must continue to follow all of their surety’s qualification and reporting requirements.

Impact on Bidding Opportunities

Contractors without a performance bond may be excluded from bidding on certain projects, as many project owners or clients require contractors to provide a bond as a condition of participation. This limitation can reduce the number of opportunities available to a contractor and may limit their ability to grow into new sectors, geographies, or client bases.

Contractual Obligations

The terms and conditions of performance bonds are typically outlined in the contract. Contractors need to be aware of and fulfill these obligations, as failure to do so may lead to a claim against the bond.

Cost of Bond Premiums

The cost of obtaining a performance bond can vary, and the premiums can be substantial. Contractors need to factor these costs into their project bids, potentially making them less competitive.

Time-Consuming Process

Obtaining a new performance bond can be a time-consuming process, involving extensive documentation and a thorough evaluation by the surety company. This process can delay the start of a project and add administrative burdens for the contractor.

Continuing to Learn

Managing a performance bond requires careful planning, attention to detail, proactive communication, and a clear understanding of the bond's terms, requirements, and potential risks. From selecting a reliable surety company to vigilantly monitoring a project's progress, construction company owners need to effectively manage their performance bonds.

Any company considering bidding on or entering into a contract for bonded work should make sure they have as much information as possible about performance bonds and know how they will affect your business.

Download our handy cheat-sheet for a quick look at the basics from this article.

If you're ready to start working on your business, let's talk!

Ascent Consulting’s mission is to Build Better Construction Companies.

We are committed to delivering impressive results in the areas of

profitability, performance, and growth.

Greg has 20+ years of financial, operational, and leadership experience in various professional sectors with a focus on construction, development, and construction management.

Leave a Comment

Your email address will not be published. Required fields are marked *